The Legacy of Bretton Woods

Why the Bretton Woods Agreement still matters . . . for now.

Signed Originals Open-Edition Prints

Legends, lore, fact, and fantasy abound about the historic meeting in the waning days of the Second World War at the famed Mount Washington Hotel in Bretton Woods that created “The Bretton Woods International Monetary Agreement”.

The historic agreement reached in Bretton Woods is still relevant, though no longer considered the prevailing agreement for trade between countries. First and foremost, Bretton Woods established institutions (The World Bank and the International Monetary Fund) and norms, as well as related succeeding agreements and policies that would continue to make the United States the preeminent force in guaranteeing the stability and transparency of trade.

This is especially pertinent to the dollar as the global currency and the legal and military infrastructure that ensures relative stability and the free flow of trade goods between countries.

Events, agreements, outcomes, and “shoulda-coulda-beens” in the mists and meandering of time are always crafted by humans who see things from differing perspectives. Most of the time, this results in interpretations that only raise more questions as historians struggle to understand important threads in the human story. The more turbulent the times, the more understanding is challenged, and the longer it takes for anything resembling a consensus to emerge. The author Jonathan Rauch writes convincingly about this in his book “The Constitution of Knowledge” - required reading for any eager amateur historian, particularly those confused by the meanderings of specific events.

However, despite this, there is no question that the storied conference at Bretton Woods, establishing the International Monetary Fund and the World Bank as well as the generally accepted international trade system has played an important part in establishing the international economic order since 1944 even as it has gradually been phased out since 1971, when Richard Nixon decoupled gold from the dollar in the International Trade concensus.

From a historic point of view, it is clear that all of the momentum moving into the negotiations in 1944 was on the side of the United States.

Britain, which had previously held the advantages of a sizable colonial empire as well as the principal trading currency, at the beginning of the War, was fighting to stay alive financially before the US actually entered the war.

All the financial and military advantage of the ground had shifted to the US and it created what became an insurrmountable advantage to the United States that held 80% of the world’s gold and 75% of the (servicable) military might, with warships capable of policing the International trade routes as well as a legal infrastructure that assured a rule of law structure that other nations could rely upon to create a level playing field as countries struggled to rebuild their economies and trading relationships.

As a quick primer on the economic order before and after Bretton Woods, it’s useful to know the following:

Before the 19th century, the system for international exchange (trade of goods and services) was quite chaotic; conducted on what, today, we would consider a barter system. Countries traded with one another through a set of bi-lateral or multi-party agreements (see below). There was no single system that all countries agreed upon, so it was necessary to have individual agreements with each country with which they did business.

Not surprisingly, during the years preceding the 1870s, the most reliable country for purposes of establishing trade was Great Britain for several reasons. Britain had earlier adopted gold as its standard of exchange and, of course, at the time it was said that “The sun never set on the British Empire” - in and of itself creating a huge advantage to the Brits.

In the 1870s Germany adopted gold as their standard for trading, aligning it with Great Britain. This created a critical mass that other countries could get behind to make their own process less chaotic. By adopting the “International Gold Standard - as it came to be known - they were able to craft multi-lateral trade exchanges with any country that also adopted the gold standard.

This system lasted from 1871 to 1914 and for the first time in world history an established trading system was created that brought a structure to the international economy. World War I, however, and its aftermath, including the Great Depression, brought the entire world’s trading system to a crisis point.

Britain abandoned the gold standard in 1931, creating chaos in the International markets, and the US and Germany soon followed.

Britain abandoned the gold standard in 1931 due to the Great Depression's economic pressures and a significant outflow of gold.

The move to suspend the gold standard had immediate consequences, including a devaluation of the British pound, making British goods more competitive internationally and boosting exports. However, it also led to a loss of value for foreign investments in Britain.

The global economic downturn of the 1930s significantly impacted Britain, leading to decreased demand for British goods and a large outflow of gold as investors sought safer currencies.

As it became more clear that WWII was nearing its end a concensus developed among most of the worlds countries that it would be imperative to develop a trading system that would allow countries, most of which were deeply in debt, to rebuild their economies.

Historian Benn Steil, whose recent account of the Bretton Woods Conference described the price of an agreement that would save the British economy as a “Faustian Bargain” for Britain.

Britain would survive at the enormous cost of its empire and its world economic primacy. It would mean ending the imperial trade preference enjoyed with its colonies. Britain would also need funds for a bridge loan to allow them to survive the first few years of peace.

FDR was not particularly interested in the conference, though he understood its importance. The real driver from the US side was Henry Morgenthau at the Treasury - a close personal friend of FDR, but also not an economist. Morganthau relied largely on Harry Dexter White, a brilliant economist who was a working-class stiff, one of 7 children from a middle-class Lithuanian Jewish immigrant family.

The US Treasury saw all this as the opportunity to break the stranglehold that Britain had over the International economy, including giving up the primacy of sterling. The US Dollar became the basic currency of world trade.

The collapse of British colonial power was practically scripted by the US Treasury, and within a few years, the British colonial empire was a distant memory.

So just three weeks after D-Day, 700 delegates from 44 nations converged on Bretton Woods. Already favorably disposed to support the US version of a “Bretton Woods Agreement”. Despite the fact that the main player on the British team was the world’s very first Rock Star economist, John Maynard Keynes. Keynes was playing with less than a full deck. His efforts were doomed from the beginning because Britain was broke.

FDR may have had little interest in monetary policy, but he did have an interest in making things happen. He chose Bretton Woods for one simple reason: New Hampshire Senator Charles Tobey, a Republican, was up for re-election, and FDR wanted to get a Republican in his corner to create an outcome that was bipartisan. A keen observer of politics and history, FDR faulted Wilson for his failure to end WWI with an agreement that united the country. He made sure to give Toby “premium billing” and won over Toby in the process.

Ultimately, the terms of Bretton Woods would make the US the world’s leader on trade and even as some policies would change over the coming years the United State’s economic leadership would be retained by virtue of the fact that they had the military power ( through both the US and NATO) to guaranty the free flow of trade goods and the stability of rule of law to settle disputes as an honest broker.

This uneasy status quo would probably have persisted well into the future but for the election of Donald Trump in 2024.

The first Trump presidency in 2016 saw some minor rumblings about replacing the dollar as the exchange currency, but the markets were not confident enough in any of the currency alternatives, including BRIC countries, and were especially skeptical that the rule of law would continue to govern under any of the alternatives. Furthermore, there were enough competent people appointed to posts in the US government who could assert a moderating influence on President Trump to temper the President’s more reckless inclinations.

The environment today has changed dramatically. World leaders have rapidly lost confidence in the stability of their relations with the US and despite President Trump’s claims that tarriffs would be a boon to the American economy - an assertion strongly countered by most economists - and his promise to have 99 deals in 99 days, few “deals” have been done and none have actually been signed. World leaders are actively developing relationships with countries that would permit them to circumvent the US.

Lawlessness and a golden age of grift are threatening the stability of our Rule of Law system. The Foreign Corrupt Practices Act, which for years had acted as a powerful constraint on corrupt practices between US businesses and corrupt government and private sector officials, has been abandoned. Elon Musk and DOGE have wiped out much of the qualified civil service that keeps embassies serving our interests, prevents terrorists from getting a foothold in our country, keeps air travel safe, and food and medicines reliably non-toxic and effective, and the list goes on.

Ten years ago, I would have predicted that the 21st century still belonged to America. I wouldn’t be so bold as to make that assertion today.

Notes:

Harry Dexter White

https://spartacus-educational.com/Harry_Dexter_White.htm

John Maynard Keynes

https://en.wikipedia.org/wiki/John_Maynard_Keynes

Ocean Born Columbine

Roaring Fork Dawn

A Rainbow of Daisies

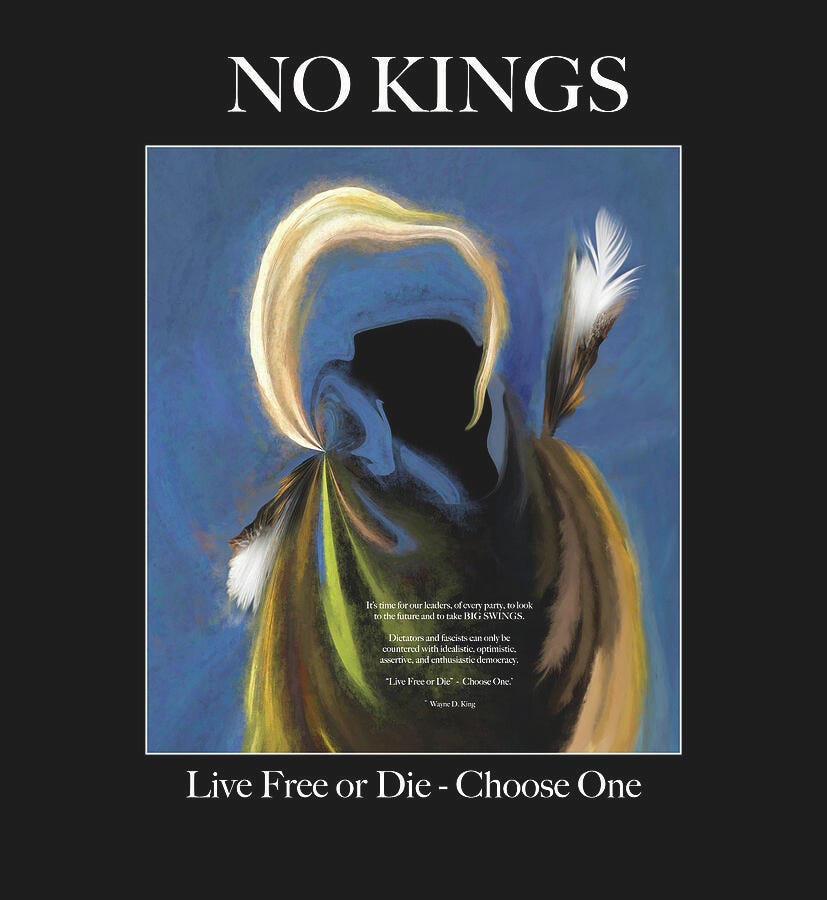

No Kings Protest Poster

Esheheman's Breath